Update: Based on a recent filing discussed in this article, it appears that MoviePass’ parent company, Helios and Matheson Analytics, is losing roughly $20mm a month. The company’s auditor included a statement of concern that it could continue operations while burning through so much cash, and it is scrambling to raise more money. The company’s leadership continues to be cagey with numbers, and it seems there is a lot of smoke surrounding the company’s financials. Meanwhile, Helios and Matheson’s CEO is making $7.8mm this year. Interestingly, MoviePass is continuing to hire, per its LinkedIn page.???!

Few businesses inspire incredulity like MoviePass.

Everyone I’ve talked to about the company wonders what the catch is and how they make money, and are shocked to learn that the MoviePass pays full price to the theaters for tickets.

I had to fight this impulse while I was researching the company. At a glance, the company seems ridiculous and doomed to fail. As I got deeper into it, it became clear that the company is a gamble on the value of the data generated by its user base. That is, if the data is valuable enough to recoup the losses from the subscription business, MoviePass could end up making money.

I don’t believe this gamble will pay off. I just don’t see the data bringing in significant revenue soon enough to make up for the rate at which MoviePass is burning through cash. But, I might be underestimating the value of granular movie preference data.

MoviePass Basics

From Wikipedia: “MoviePass is an American subscription-based movie ticketing service. Founded in 2011 and headquartered in New York City, the service allows subscribers to purchase a single movie ticket per day for a flat subscription fee per month.”

Some quick facts:

- Until 2017, the unlimited ticket plans cost around $50/month, with two movie/ month plans at ~$15

- MoviePass subscribers receive a special debit card, which MoviePass then loads with money to pay for tickets

- MoviePass does not receive a discount on tickets from the vast majority of theaters

- In August 2017, MoviePass lowered its price for unlimited movie tickets to $9.95/month

- At the same time as the massive price drop, MoviePass sold a majority stake to analytics firm Helios and Matheson, and explicitly became a “data play”

- Predictably, demand has skyrocketed since the price drop, and MoviePass has gotten significant press since dropping the price

- The current CEO is Mitch Lowe, a former Netflix and Redbox executive

Key Statistics

Various data I’ve seen, largely coming from MoviePass executives (so believe them at your own risk).

- The average price of a movie ticket in the U.S. is $8.73

- MoviePass had around 20,000 subscribers at its old price point (around $50/month)

- It has now ballooned to 1.5 million + subscribers at the new price point (~$9/month)

- 75% of MoviePass subscribers are millennials

- Without MoviePass, median American goes to 4-5 movies per year

- With MoviePass, people go to ~10 movies / year, according to the CEO

- MoviePass subscribers spend more than twice the average amount on concessions

MoviePass’ Key Financial Determinants

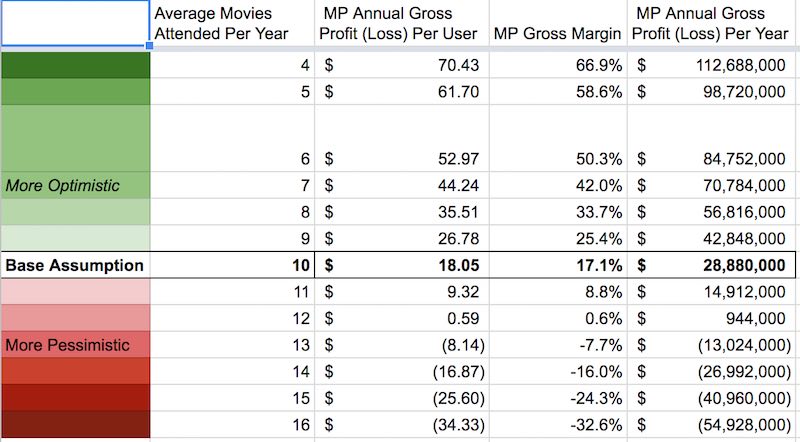

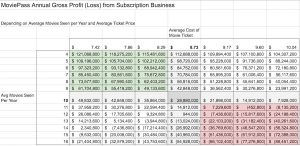

How much MoviePass makes or loses on its subscription business depends largely on how many movies people see each year and how much people pay to see those movies. I put together a sensitivity analysis in Google Sheets that shows MoviePass’ gross margin and profit per user for various assumptions of movies per year; their breakeven point is right around 12 or 13 movies each year. Check it out here.

Movie Frequency

In a recent interview, Lowe, MoviePass’ CEO, said that people end up going to around 10 movies a year if they have MoviePass. This actually rings true to me; I think generally people overestimate how much they’ll use a service like this.

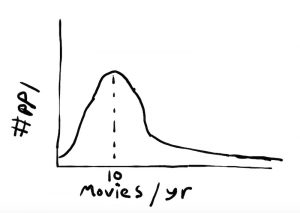

However, it’s important to keep in mind that it really is the average number of movies people see each year that matters for MoviePass’ financials; and this average will almost certainly be a good deal higher than the median.

I’d expect the distribution of movies / year to look something like this:

I’d believe that the median customer sees around 10 movies a year, but this will undoubtedly be dragged up by a long tail on the right of people who see 30 + movies each year.

Ticket Prices

I am also quite skeptical of the $8.73 average ticket price. Lowe was quoted in Business Insider saying, “We need to offset costs in Manhattan and L.A. by getting a lot of people in Kansas City and Omaha, and places where the average ticket price is five or six bucks to sign up.”

Now, I live in Cincinnati, Ohio. Perhaps a bit pricier than Omaha, but still quite cheap. And I saw Call Me By Your Name for 8 dollars on a Tuesday night last week and was excited to pay that price. I saw Black Panther the second week it was out for $14 and didn’t blink at the cost. So the number itself just feels suspect to me.

Probably more importantly, if people have an unlimited debit card to see whatever film they want, they don’t need to be selective about price! It’s exactly the same moral hazard problem that people love to harp on in health insurance debates. There’s no incentive to shop around if you’re not footing the bill for the ticket, so why worry about going to a discount theater or a matinée? I’d expect this would pop the effective average ticket price for MoviePass by at least 20%.

Acquisition Costs

As surprising as it seems, MoviePass has started to spend money on acquiring users, even at this price point. I know this because I got a targeted Instagram ad from the company today after googling them a bunch! Like any other product, acquisition costs will further squeeze their margins (or, as the case may be, increase their losses).

MoviePass’ Potential

The movie theater industry in the U.S. brings in roughly $40 billion in revenue a year. For scale, Facebook brought in just over $40 billion in revenue in 2017. If MoviePass achieves its goals, it will grow this market (more people will go to movies) and it will take a sizeable bite out of it and, potentially, adjacent markets (ridesharing and dining that happens before and after the theater).

The company is not receiving any help from the established theaters. The big movie theaters don’t like MoviePass. Although it’s helpful in the short term (it sends people to movies and foots the bill, after all) it is getting customers used to a ridiculously low price point. If MoviePass raises prices or goes belly up, it could leave behind a lot of customers who are not accustomed to paying 10+ dollars for a single movie ticket.

Still, if MoviePass can survive long enough that its userbase gets big enough, it will have substantial bargaining power with the big theaters. It could start to get a discount on tickets, share in high-margin concession revenue, and charge for ad placements. The marketing budget for big movies is in the $200 million range—if MoviePass starts to capture a chunk of that, it could make up for its crazy burn rate.

How much will studios pay for MoviePass data?

The success or failure of MoviePass comes down to how much studios are willing to pay for its data; either directly or through advertising. I am inclined to believe that this won’t be nearly enough to make the company profitable. MoviePass executives claim that they’re the only company that can tell whether someone actually saw a movie, and that this makes the data immensely valuable. But if this is true, why isn’t Rotten Tomatoes super valuable? It has similar data and an established userbase and did not have to burn piles of cash to get it.

Lowe has grand ambitions to partner with Uber to get you a ride to the theater and restaurants nearby movie theaters to put an entire night out on the MoviePass platform. I have heard companies have these ambitions before, and at the very least they present a mountain of execution risk. It’s hard to pull off deals like this, even if in theory they sound great.

I am excited to watch the drama with MoviePass play out this year. I don’t even need a ticket!

Do you have a view on the value of MoviePass or the direction of the company? I’d love to hear thoughts from those who are close to this space. Get @me on Twitter and tell me what you think.

If you enjoyed this analysis, check out my examination of WeWork, another ambitious and controversial startup.