WeWork is a fun company to analyze.

Its valuation is huge, its business model is changing fast, and it has a charismatic, audacious CEO. It’s flush with SoftBank cash and has deployed it in some interesting ways. It also epitomizes the divisive stereotype of the yuppie / techie / millennial that inspires both mockery and admiration, depending on who you’re talking to.

I have been mostly skeptical of WeWork’s valuation and future success:

Whoa. Is anyone besides SoftBank optimistic about WeWork? It seems so bubbly from the outside https://t.co/l6TZlZuJO4

— Joe Hovde (@Jhovde2121) November 28, 2017

Its acquisitions struck me as unfocused, and I didn’t see anything defensible about the co-working model. I also think that tech culture generally and the WeWork brand by extension are seeing a sharp drop in public goodwill, and that belonging to a WeWork won’t be a positive signaling device in the near future. The public image of finance still hasn’t recovered from 2008, and I think tech will see a similar (if somewhat less pronounced) popular backlash.

Still, after digging into the company I found some reason for optimism. Mainly, I think the company’s services arm, Powered By We, will be a big part of WeWork’s future success. There are some network effects / data moats that I hadn’t considered that will help defend WeWork’s business as it continues to scale. While I don’t see the company reaching Facebook or even Uber-level valuations anytime soon, I think with good execution it will become a profitable company.

Update: I just read this post by Mark Suster and really liked the analogy of WeWork to cloud computing: Instead of paying for a fixed amount of office space (server space) upfront, a company can use and pay for what they need as they scale. Thinking about it this way makes me more optimistic about WeWork, though I still have issues with their brand and the way the company is run.

WeWork Quick Facts

- Founded in 2010, headquartered in NYC

- Raised $4.4B from Softbank in 2017

- Roughly $900MM in revenue in 2017

- $20B valuation at last funding round in summer 2017

- CEO is Adam Neumann

Core co-working business

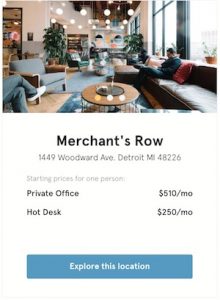

WeWork began and is still mostly known as a co-working business. Individuals and small teams can rent out space in a WeWork on a tiered scale (as low as 1 day / month floating desk and up to unlimited use of private office space).

WeWork leases the office space on a long term basis (15 – 20 years) and makes money on the spread between what it charges tenants for office space and what it pays for the long term leases. It has benefited from singing many of these leases while real estate in large cities was still relatively cheap following the 2008 financial crisis.

Many have remarked on WeWork’s enormous valuation compared to other office leasing companies. For example, Regus has a similar business model and is valued at just over $2B on roughly $3B in revenue. Boston Properties is valued at roughly $18B on $2.5B in revenue, but Boston Properties owns the space it rents out, while WeWork rents it. WeWork is clearly valued as a tech / growth company, at a $20B valuation on shy of $1B in revenue.

Growth in Freelancing

I believe there will be growing demand for co-working space in general, as more and more people become freelancers (one study predicts that 50% of workers could be freelancers by 2027; even if this is optimistic it seems likely that the trend will continue). There is definitely value in having a community to work in and other professionals to network with, and I think co-working is absolutely here to stay.

However, at its current price points, WeWork seems like a luxury that will be one of the first things to go when the economy drops. I do not think people will be willing to shell out hundreds of dollars a month to work in a hip office space with free beer on tap when the market isn’t humming along. WeWork has only been around since 2010; it’s never seen an economic climate that’s not steady growth. I imagine WeWork will come out with cheaper price points, but no matter how low it goes, co-working is a luxury for freelancers, not a necessity.

Powered By We: Pushing into Services

I hadn’t heard of WeWork’s service arm, but upon learning about it, I’m convinced it will be the most successful part of the company in the next ten years. The idea is this: WeWork has amassed a lot of data and expertise on how people use office space from its own co-working spaces. It’s also developed products to optimize these spaces, from room-booking software to internal networking apps. Powered By We is WeWork’s move to package what it’s learned about how to make offices run smoothly and sell it to other companies as a service.

I like this idea for the following reasons:

- It will get better as WeWork scales and gets more data. This makes it defensible

- Workplace design is a relatively overlooked consulting proposition; it’s not something companies have been too scientific about

- It grows WeWork’s addressable market massively without adding the risk of new leases that opening physical WeWork locations brings

- It’s much more resistant to economic downturns than co-working is

Powered By We will bring a lot of value not only to companies looking to make their employees happier and more productive, but to companies looking to cut cost on real estate. One of the most fascinating aspects about WeWork is that it’s used its data to find ways to save space: WeWork averages around 60 square feet / employee, while the average in the 2000s was anywhere from 200 to 400 sq ft / employee.

This sort of insight can make WeWork’s services valuable in bad economic climates as well as good ones. It’s not just helping companies do the fluffy stuff (where to put the beer bar so that it maximizes interaction between employees) but it is helping companies do more with less. So companies that are flush with cash and growing can hire WeWork to help them get to the next level, and companies needing to slim down can hire WeWork to help them cut costs.

WeWork made roughly 30% of its $900MM in 2017 revenue from enterprise clients; I’d expect that to grow both in gross and relative terms.

If it works

Should Powered By We succeed, the company could grow into an interesting mix of a consulting firm / data provider / co-working company. An analogy that comes to mind is Nielsen, which collects and aggregates retail data and then sells it to retailers along with consulting services. WeWork is in something of a similar position, except it owns all the data and makes money off of its generation (from its co-working business). It would also have a larger market; any business or organization looking to optimize its physical space could use Powered By We, while Nielsen’s data is specific to retailers.

Still, WeWork is already valued at around double Nielsen’s market cap! While I think WeWork’s service business has a lot of promise, it still seems to me that the company is overvalued, given all of the execution risk that remains.

Other Revenue Streams

WeWork has tried out some other business lines and there are certainly a lot of ways it could diversify. So far, it has gotten into:

- Co-living spaces with WeLive. This launched in 2016 and hasn’t been a big success, as much as dorms for rich 30-somethings seems like a fun idea

- Gyms with Rise. Gyms actually seem like a business that WeWork could do well taking its data-driven design approach to. I imagine most gyms are designed sub-optimally and I could see WeWork competing with Equinox in the high-end urban gym space

- Meetups, with the meetup.com acquisition. This is a tough space to make money in but it does seem in line with WeWork’s general mission and could augment its existing technology offerings

- Early stage investing with WeWork Labs: this is a natural line of business for WeWork, which can keep tabs on lots of different startups and provide value in the form of office space and connections

- Kindergartens (!) with WeGrow, opening this year and headed by CEO Adam Neumann’s wife Rebekah

These and lots of other areas will compete for WeWork’s investment. The company is flush with cash and is certainly not afraid to spend it; it remains to be seen if it can maintain the focus to build real, strong business lines with its attention being pulled in so many directions. Neumann is clearly an energetic and passionate entrepreneur; but being the founder of a startup is totally different than leading a large corporation. Obviously some people can have fun while staying focused, but he just doesn’t strike me as having the discipline of a Zuckerberg or a Bezos:

WeWork hasn’t IPOd, but CEO Adam Neumann has bought:

-$28 M penthouse in Gramercy

-$15 M estate in Westchester

-$11 M townhouse in W Village

-$1.8 M Hamptons house-also rents apt where similar unit goes for $45k a month https://t.co/jkgXmCzFn9https://t.co/vfCOD9slHt

— Eliot Brown (@eliotwb) December 11, 2017

I expect WeWork to grow into a profitable company on the strength of its service offerings. But I believe it will take its lumps along the way and will be forced to refine its business model before it raises more money at a higher valuation. WeWork is clearly having fun playing with house (Softbank) money, but will need to come down to earth sooner or later.

I’d love to hear your thoughts on WeWork; email me or let me know on twitter. If you enjoyed this analysis, check out my examination of MoviePass’ business model (it makes WeWork look like Berkshire Hathaway).

If you sign up below, I’ll email you when I write something new: