I have a bad habit of reading successful people’s bios.

Be it on LinkedIn, Twitter, VC Websites…there’s something about the concentrated shot of prestige I find addictive. Stanford! McKinsey! HBS! Sequoia Capital! Spending time with my kids! It’s enough to make you sick.

In that vein, I decided to analyze a bunch of VCs’ bios to see what themes come up over and over again. I scraped the text from 600+ VC professional bios, using this list of the top VC funds as a guideline for which firms to use. It was a little repetitive, but not very difficult. I used R to scrape and analyze the data; you can see the code on github if you’re interested.

Most VCs’ bios follow a pretty standard format. “This is my role, I’m passionate about these industries, I’ve funded these companies, I worked at these firms in these roles and went to these schools, in my free time I like to do this.”

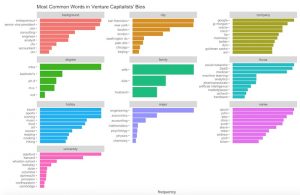

Below are the most common words across 10 categories I came up with:

Here is an interactive view of the same data using Tableau that may be easier to read:

Some fun observations:

- VCs like travel, running, soccer, tennis, golf and cooking. I feel like a thirty-something VC is Blue Apron’s ideal customer

- Lots of venture capitalists studied engineering or economics

- Many VCs are alumni of big tech companies like Cisco, Oracle, Google, IBM etc; lots also come from top investment banks (JPM and Goldman Sachs) or consultancies (McKinsey, Bain etc.)

- There are also a lot of VCs who are former entrepreneurs themselves. My impression is that lots of the VCs at younger firms are former founders

- This is a less fun observation: the “top names” are comically male and comically white

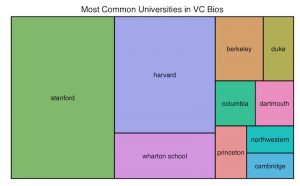

Where did VCs go to school?

I found the “Universities” group to be particularly interesting, not so much because of the schools on the list but because of how concentrated it is at the top. So many venture capitalists have ties to Harvard or Stanford! It’s really pretty staggering. I don’t have a definite explanation for this—maybe it reflects the premium VC puts on personal connections? It’s notoriously difficult to “apply” for jobs in venture capital; most of the time people make their way in through introductions. This would seem to concentrate the industry into pre-made networks like HBS / Stanford.

I’d expect that if you did a similar analysis of alma maters of top surgeons, for example, you’d see a lot more variation in universities, because becoming a surgeon is based more on objective test scores / performance and weighs connections relatively less than VC.

What’s notable here is that while it may seem unfair to hire a Harvard grad over an equally intelligent Brown grad is that because connections are so important to success in venture capital (referrals, partnering on deals etc.), the Harvard grad actually does bring more value to a firm, all things equal. The university does not just serve as a signaling device on a candidate’s intelligence; it is a good indicator of how broad a candidate’s network of other VCs will be. So the system’s inherent biases reinforce themselves in multiple ways—Harvard people know Harvard people and thus hire them, and the importance of connections in VC make the Harvard people more successful because they have strong built-in networks in VC from the get-go. This virtuous/vicious cycle (depending on your perspective) will make diversification of VC particularly difficult.

Want access to the data?

Email (joe at this website) or tweet at me and I’ll give it to you. I’ve thought about selling access to it as it seem like it might be of value to founders looking for VCs to pitch (the names of the VCs are in the dataset, so a founder could for example search for VCs who are interested in fintech, went to Stanford and like cooking). If you have any feedback about that, or can think of an alternative use for the data let me know.

If you’re interested in venture capital, check out my article on books VCs recommend. It is probably more actionable than going to Stanford and being named David, unless you went to Stanford or are named David.